how to pay late excise tax online

Taxes and Filing. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually.

For your convenience payment can be made online through their website.

. The government has so far collected around P440 billion in excise tax and import duties including value added tax VAT from petroleum products as of late May 2022 since the. Item 1 - Serial Number. Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late.

Paying excise duty on excisable alcohol. Appointments for all offices can be made by calling 866-285-2996. You can mail your check or money order tax payment.

Get your bill in the mail before calling. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. File and Pay Online.

In this example 2000 is the. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. When calculating the sales tax for this purchase Steve applies the 40.

The tax collector must have received the payment. Notice 2021-66 provides an initial list of taxable chemical substances. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills. An envelope is included with your tax bill. Town of Eastham PO Box 53.

The Department of Finance DOF administers business income and excise taxes. Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to. You must create a serial number in this format.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. TRD offices are open by appointment only. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

Not just mailed postmarked on or before the due date. A motor vehicle excise is due 30 days from the day its issued. The city or town where the vehicle is principally garaged levies the excise and.

Your obligation as a taxpayer will depend on your circumstances. To complete a search you must provide several pieces of information to ensure we match you to the bills in. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue dateFor Vehicles on the road January 1.

The request must be made before the due date. Majority of bills are due in late March or early AprilMotor Vehicle Excise Tax bills are issued each calendar year to each owner of a vehicle registered in Massachusetts. Excise tax return extensions.

A customer living in Mililani Hawaii finds Steves eBay page and purchases a 350 pair of headphones. Generally if you hold an excise licence you need to lodge an excise return and pay excise duty before you deliver excisable products into the Australian. For example if you owe 2500 and are three months.

You pay an excise instead of. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. 2000-01 for PERIOD returns and in this format P-2001-001 for PREPAYMENT returns.

Depending on the circumstances the Department may grant extensions for filing an excise tax return. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. For on-time payments please mail payment coupon check to.

As a TTB-regulated industry member you may be responsible for paying federal excise taxes. General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

The status of a refund is available electronicallyA social security number and. Form 433-B Collection Information Statement for Businesses PDF. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for. DOF also assesses the value of all New York City properties collects property taxes and other property. Tax Department Call DOR Contact Tax Department at 617 887-6367.

Corporate Excise Tax Penalties Waived S Corporation Fiscal Year Corporate

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

Motor Vehicle Excise Tax Wellesley Ma

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Look Up Pay Bills Town Of Arlington

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Have You Paid Your Excise Tax Bill Yet 2019 Motor Vehicle Excise Taxes Are Due On Saturday March 23 North Andover News

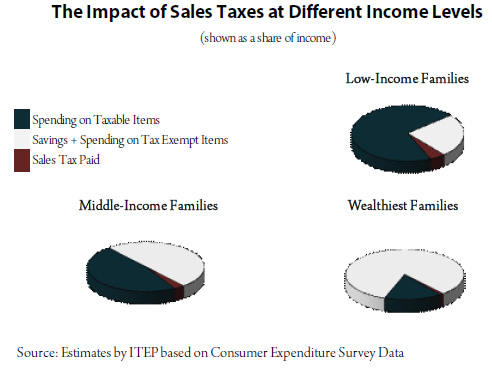

How Sales And Excise Taxes Work Itep

Online Bill Payment Town Of Dartmouth Ma

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Find Accounts Training Taxation Practical Training Cloud Accounting Training In Delhi Tally Erp 9 Trai Accounting Training Cloud Accounting Accounting Software

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online